This guide explains how to qualify for, activate, and manage Home Depot Memorial Day special financing offers so you avoid surprise interest and fees. You’ll get practical steps for the store credit application, deferred-interest promotions, what to bring to checkout, and timing tactics that matter during the sale.

Scope Boundary: This guide focuses on qualifying for and using Home Depot Memorial Day financing offers (store credit and promotional plans); for broad lists of current promo codes and all coupon strategies, see our Hub guide below.

Quick Checklist

- Decide if you need financing vs. paying with cash or card before adding items to cart.

- Pre-apply for a Home Depot Consumer Credit Card at the Credit Center to speed checkout: bring SSN and photo ID.

- Confirm the Memorial Day promotional term (e.g., 6, 12, 18 months) on the product page before checkout.

- Estimate the minimum monthly payment to avoid deferred-interest traps; plan a payment calendar.

- Keep documentation: approval screenshot, promotional terms, receipt, and the promo plan code.

- For large appliances, confirm delivery and service fees and whether financing covers those charges.

- If applying in-store, ask for a manager to confirm promotional codes and the exact plan length.

- Check your credit pull disclosure immediately after applying so you can dispute errors fast.

How Home Depot Memorial Day Financing Works (Deep Dive)

Home Depot often pairs Memorial Day discounts with promotional financing: store credit accounts, deferred-interest offers, and limited-term promotional APRs. The core difference is whether interest accrues and how unpaid balances are handled at term end.

Types of financing you may see

- Store credit card (revolving): a Home Depot consumer credit card you can use anytime; approvals depend on a soft or hard credit inquiry.

- Deferred-interest promotions: pay within 6–24 months and avoid interest if you finish payments on time; if you miss the deadline, interest is charged from purchase date.

- Promotional low-APR plans: fixed low APR for a set term; interest applies from day one but at a reduced rate.

Knowing which plan is attached to the Memorial Day discount matters. Read the fine print where the promotion is advertised and on the product detail page to confirm whether a deferred-interest or low-APR plan applies.

Step-by-step: Applying and activating in-store or online

- Pre-apply online at the Home Depot Credit Center (recommended): go to Home Depot Credit Center to start the application and get a pre-approval decision.

- If approved, note the account number and any immediate-use instructions—some approvals allow instant use at checkout.

- When adding Memorial Day items to cart, verify the promotional plan on each eligible item and confirm the plan code at checkout before finalizing the purchase.

- Retain screenshots of the promotion language and the final checkout page that lists the promotional term.

Timing and payment tactics to avoid interest surprises

Deferred-interest deals are tempting but risky if you don’t plan. The common trap is assuming you can pay the advertised monthly minimum and still avoid interest. In reality, you must fully repay the deferred balance within the promotional term.

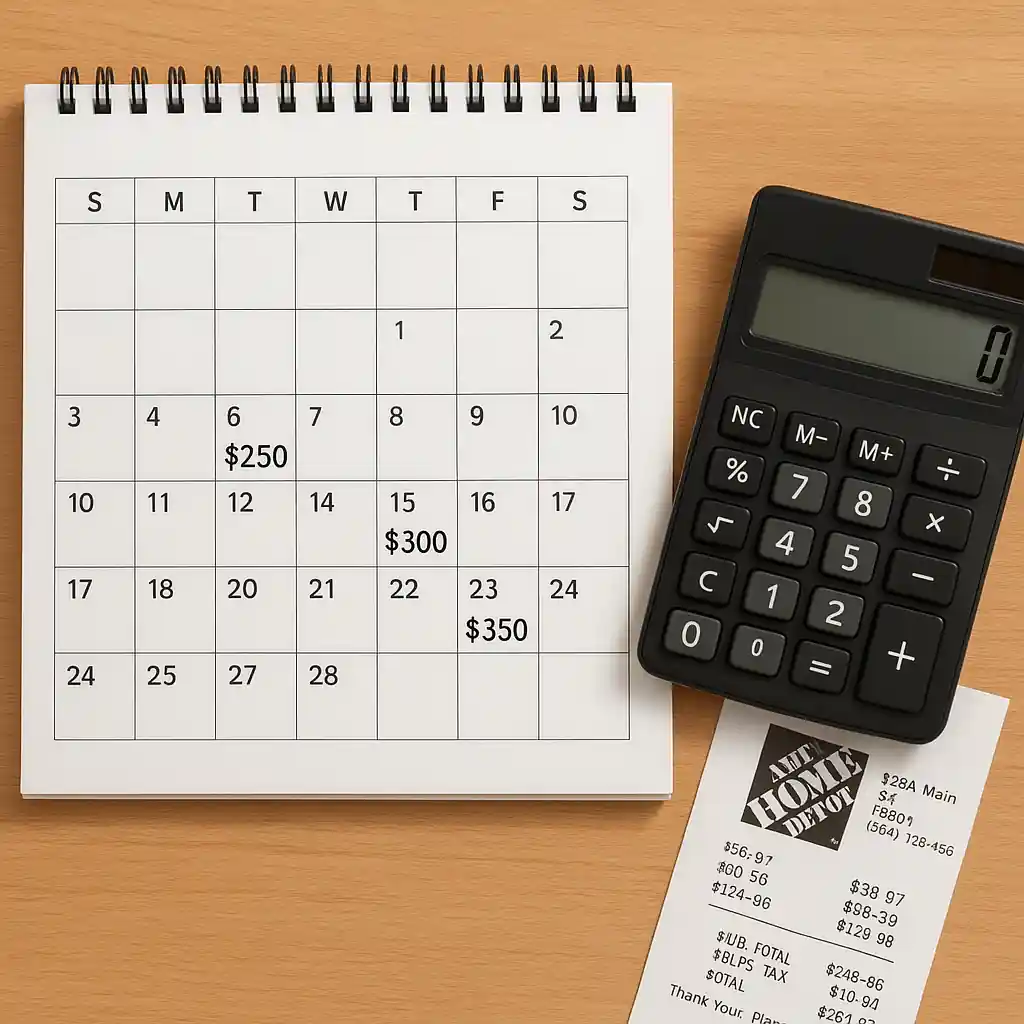

Simple amortization flow to plan payments

- Calculate the full payoff amount: total financed balance (purchase price + taxes + eligible fees).

- Divide by the number of months in the promotional term to get the monthly required payment to avoid leftover balance at term end.

- Add a small buffer (1–3%) to cover rounding and possible extra fees.

- Schedule automatic payments so you never miss the final month deadline.

Note that some promotions exclude delivery or installation fees. Confirm whether those charges are eligible for the promotional plan. When in doubt, ask the cashier to print the promotion details and the order summary showing promotion codes.

What documentation and credit checks to expect

Applying for a Home Depot card typically requires an identity check and either a soft or hard inquiry. If you pre-apply online you can often see whether the check is a hard pull. Prepare the following:

- U.S. government photo ID (driver’s license or passport).

- SSN or ITIN for the credit check.

- Recent address and one financial reference (bank account or recent mortgage/loan info) if asked.

- Proof of income if the application requests it; have a pay stub or bank statement handy.

After approval, the credit card account will carry the promotional plan. If a hard pull occurred, monitor your credit report for accuracy and keep the approval and terms email in your records for 24 months.

Common Mistakes

- Assuming the minimum payment equals what you must pay to avoid deferred-interest—this often leaves a balance and triggers retroactive interest.

- Forgetting to include taxes, delivery, or installation in payoff calculations; those can push you over the promotional payoff amount.

- Applying for financing at the register without pre-approving; declined approvals at checkout can delay a sale and lock you into paying full price.

- Missing the exact promotional end date—deferred-interest promotions charge interest from purchase date if the balance remains after term end.

- Not saving the printed or emailed promotional terms: dispute resolution requires the original terms showing the plan length and exclusions.

- Using a new account immediately for multiple large purchases without confirming combined promotional eligibility; some programs limit stacking across transactions.

- Overlooking that promo plans sometimes exclude certain items like gift cards or services; assume exclusions until verified in writing.

- Failing to set automatic payments or calendar reminders; human error is the most common cause of lost deferred-interest protections.

Related Guides

- Hub: Read the full Home Depot Memorial Day Sale hub for complete sale timing, category deals, and broader coupon strategies.

- Adjacent: If you’re buying appliances, see our page on Memorial Day appliance deals to confirm delivery and hookup fee coverage under promotions.

- Adjacent: For stacking tips with coupons, check how to stack coupons with Home Depot’s Memorial Day sale.

When linking terms back to the hub and adjacent guides, use those pages to confirm item-level exclusions or local ad variations before you finalize financing.

Conclusion

Memorial Day financing at Home Depot can make large projects affordable, but only when you understand the plan type, include taxes and fees in your payoff math, and keep strict payment discipline. Pre-apply for credit where possible, save the promotional terms, and schedule payments to match the payoff schedule.

Next step: visit the Home Depot Memorial Day Sale hub to pair financing advice with current sale timing and category picks.